US economics, inflation and geopolitics

Stubbornly high inflation is weighing on the U.S. consumer. Retail sales figures for March showed elevated prices for food and energy commodities (natural gas recently surged to a 13-year high), which significantly increases the monthly necessities bills for U.S. households according to Value Line. This may force consumers to defer purchases of discretionary items, a trend that may well reduce GDP growth during the spring and summer months. All signs suggest the Federal Reserve is behind the curve in its attempt to combat inflation. This will likely result in more restrictive monetary policies over the balance of 2022 and next year, including a few half percentage-point hikes to the benchmark federal funds rate, to try to rein in surging prices at both the producer and consumer levels.

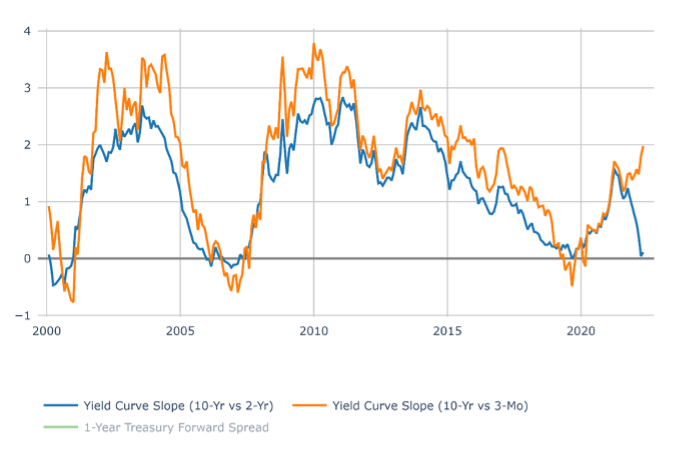

Inverted yield curve

Recently yield curve (the difference between 10- and 2-year treasury yield) got briefly negative or inverted as rates markets priced in accelerated Fed tightening. Usually, the inversion of the yield curve could be an early sign of an upcoming recession. However, we believe the curve may be more prone to inversions today given low absolute yields, quantitative easing, and elevated inflation. Moreover, 10-year to 3-month curve is actually steepening pointing to a still-growing economy. The historical time lag between an inverted curve and a recession has ranged from 7–35 months. During that time, the S&P 500 continued to deliver positive returns on the median. We believe a recession is not on the immediate horizon and the US economy is resilient enough for the time being.

Chart 1: Yield Curves (as of 03/31/2022)

Source: Signet Financial Management, LLC

Global economics

The recent inflation surge is generating two very different challenges to global expansion. The immediate one comes from a dramatic squeeze in household purchasing power, concentrated in Europe and low-income commodity-importing nations. If, as J.P. Morgan expect, growth proves resilient in the face of this shock, then the risk arises that the inflation surge will pass through to price and wage setting, which would require tight monetary stances. With the private sector unusually well-positioned to absorb shocks, they have banked on resilience and are encouraged by the signal from the data flow suggesting the expansion is being dented but not derailed.

Next GDP reports for the US and Euro area should confirm that developed markets (DM) growth slipped last quarter, but the message from incoming reports is that a large purchasing power drag on households is being cushioned by other forces that set the stage for a rebound this quarter. First and foremost, businesses continue to expand smartly with capital expenditures, inventories, and employment on track to post robust 1Q22 gains. The underlying fuel for this impulse is not likely to be depleted soon, as a surge in corporate profits associated with elevated productivity growth and inflation has pushed DM margins to record levels. Second, inflation depressed goods spending last quarter, but service-sector spending is rebounding as the Omicron drag fades outside China. This week’s April reading showed a surprising rise in the Euro area services PMI. While the US PMI dipped, J.P. Morgan expect March personal consumption report to show real services spending gaining momentum as 1Q ended. J.P. Morgan upped its US GDP forecast for 2022 from 3.3% to 3.6% and kept its global GDP forecast at 3.4%.

Equity portfolio management

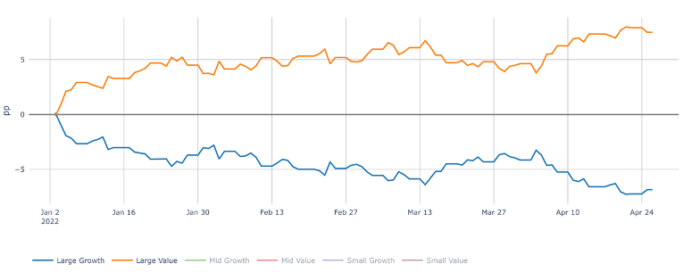

With the Fed getting serious about inflation and prepping the markets for multiple rate hikes, the market keeps rotating from Growth to Value with some Growth trying to come back in early April only to drift down even further later in the month (see Large Growth vs. Value chart below). As we find ourselves in the middle of the earnings season, companies report well, but the reaction towards healthy earnings is muted due to the concern that the Fed will be too aggressive with rates. Recently we listened to the latest Empirical Research market update, and they highlighted a state of uncertainty — with their regime indicator neutral (no preference between Value or Growth). On one hand, their Valuation spread is at neutral as well, on the other hand, they do see Growth GARP (Growth at Reasonable Price) stocks as being historically cheap, and should the economy slow down enough due to aggressive Fed’s actions, they believe those Large Cap Growth “GARPers” could outperform.

Chart 2: Large Growth and Value SP Indexes Alpha 2022 YTD (as of 04/26/2022)

Source: Signet Financial Management, LLC

At the same time, they believe the market overreacts and underestimates the resilience of the US economy towards higher interest rates. The arguments for a strong US economy are a strong labor market, healthy housing demand, and resilient corporate profit margins. Thus, the US economy will continue growing and Value plays would continue outperforming.

We think in this uncertain environment it is prudent to keep our barbell posture with the emphasis on profitability and Free Cash Flow (FCF) production. Profitability is one of the most stable factors which does well in different investment regimes. As we are working on rebalancing some of our actively managed equity strategies, we will be looking for companies with healthy profits and FCF yields and favorable dynamics.

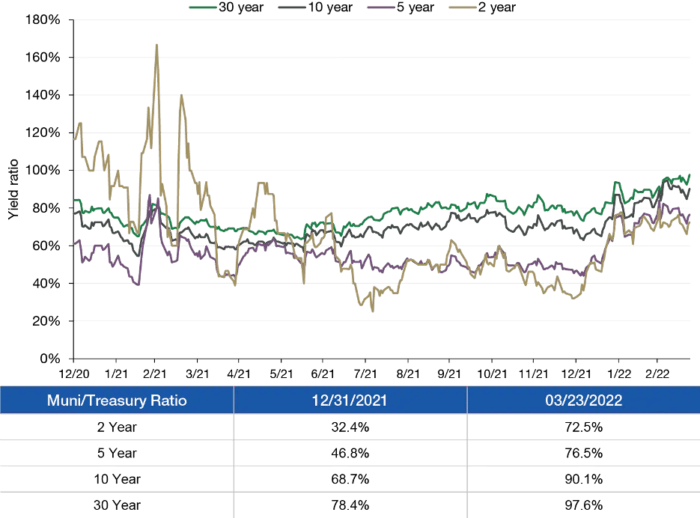

Fixed income

Despite the fact that bonds are under pressure from higher interest rate expectations, we find opportunities in the space. Muni/Treasury ratio rising — muni bonds yields going up relative to Treasuries. As you can see in the table that accompanies the chart below, the 2-year ratio has gone from 32% at the end of 2021 to 73% as of March 23, with sizable upward moves in the 5-, 10-, and 30-year ratios as well. When ratios rise to this degree, it means the municipal bond yields are going up faster than U.S. Treasury yields. A recent commentary on lordabbett.com noted that historical periods of large outflows from municipal-bond funds have typically been followed by strong recoveries in the muni market.

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, J.P. Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.