The rent vs. buy debate could soon take another turn.

Millions of Americans have been priced out of homeownership amid a red-hot housing market, but even renting has become less affordable in the past year. That’s been squeezing households’ already-tight disposable income—and their savings accounts.

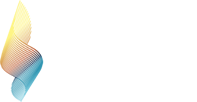

In March, rent prices for properties with two bedrooms or less grew 17% year over year, with the median asking rent reaching $1,807 per month, according to data from Realtor.com. It was the eighth month in a row that rent prices saw double-digit year-over-year growth.

(Barron’s and the company that operates Realtor.com are both owned by News Corp.)

The surge in rental prices was partially due to skyrocketing home prices. That’s forced many potential home buyers, including aging millennials, to shelve their plans and keep renting for longer. Meanwhile, Gen Z is hitting the rental market, with many of its members looking to get their own place as the pandemic wanes.

Many eviction moratoriums have long expired. And the high demand has driven many landlords to raise prices, in part to recoup their pandemic losses. The current rent spikes likely still have a long way to go: Home-price growth has tended to lead rent inflation by about 18 months, according to a research paper from the Federal Reserve Bank of Dallas published last year.

Higher rents could push many Americans to pull the trigger on buying a home. “The fact that rents are rising is an important push factor that might keep potential homebuyers motivated even though home prices and mortgage rates are both going up, ” says Danielle Hale, chief economist of Realtor.com. “Because the monthly housing costs are going up, whether you are looking to rent or buy.”

Where Has Rent Increased the Most?

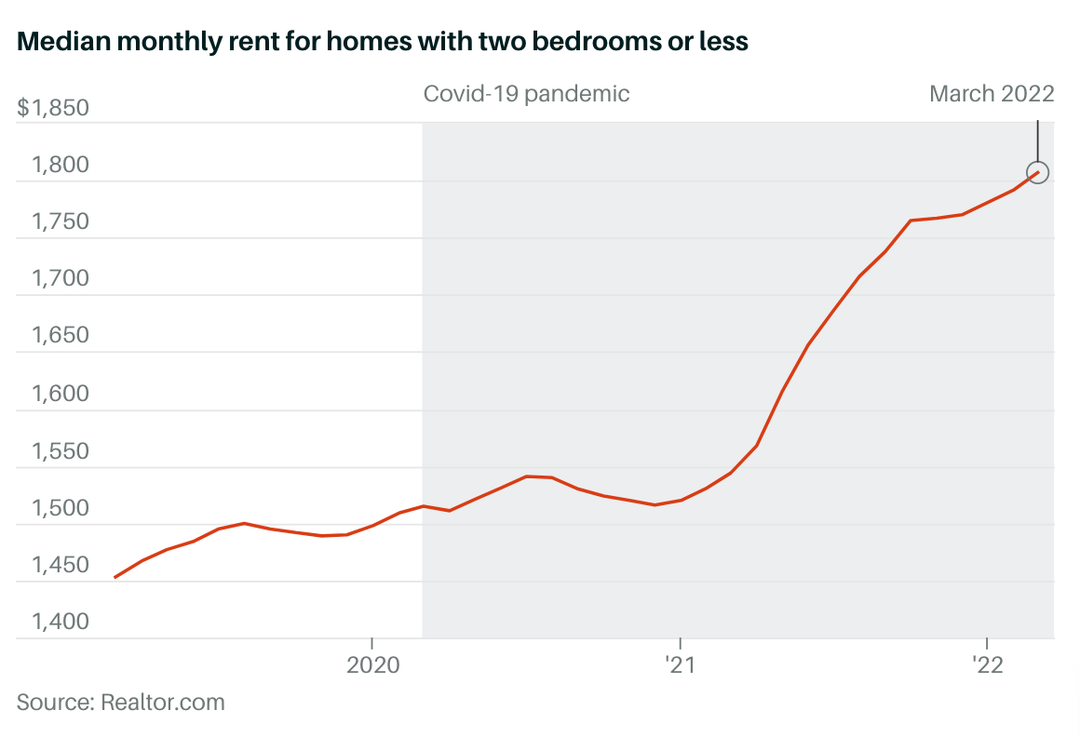

Miami residents might not think they live in paradise: In the past year, the median monthly rent for a home with two beds or less shot up 57% to $2,988 from $1,900, according to data from Realtor.com. That means Miami rents climbed faster than they did anywhere else in the country. With the recent gains, the Miami metro area, which includes Miami, Fort Lauderdale, and West Palm Beach, has become the fourth-most expensive rental market in the U.S., higher than both San Francisco the New York metro areas.

One contributor to skyrocketing rents is the many luxury apartments newly developed in Miami, catering to the high-end clientele that recently moved to the city for its warmer weather and lower taxes, says Hale.

Miami is not alone. The data showed that median monthly rents in 15 metro areas, including Orlando, Fla.; Tampa, Fla.; Austin, Texas; Las Vegas; and San Diego, have all climbed by more than 20% from last year. Rents in the traditionally expensive New York and San Francisco metro areas, on the other hand, have grown more modestly, by 14.6% and 11.4%, respectively.

Can Renters Afford the Price Hikes?

As rents skyrocketed, American workers’ incomes didn’t keep up. According to data from Moody’s Analytics, even well-to-do tech hubs like San Francisco and Austin have only seen their median household income increase by 3% over the past year—far behind soaring rents.

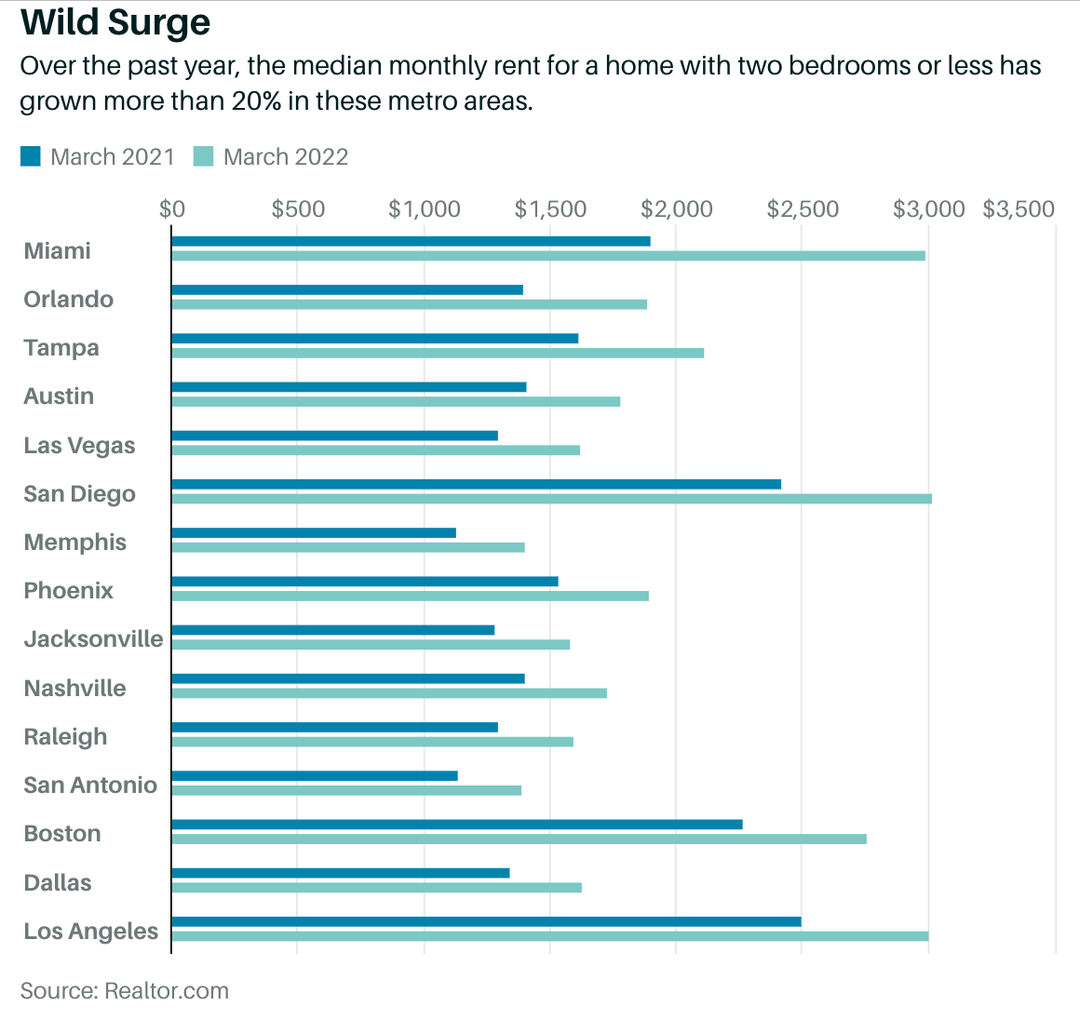

A widely accepted rule of thumb for measuring rental affordability is that a household should spend no more than 30% of its income on housing costs. Realtor.com economists compared median monthly rent to the estimated median monthly household income in February—and found that 14 of the top 50 metro areas in the U.S. failed to meet this threshold.

The Miami metro area was the least affordable rental market in the U.S., the economists found. With a typical monthly household income of $4,923, families in Miami would need to spend nearly 60% of their paychecks to rent a typical home with two bedrooms or less. That’s a hike of 22 percentage points from 12 months ago—when the market was already unaffordable.

Los Angeles; Riverside, Calif.; Tampa; and San Diego were also among the least affordable rental markets in the U.S. All have seen their rent-income ratios worsen over the past year.

Meanwhile, Kansas City, Mo.; Oklahoma City, Denver, St. Louis; and Washington, D.C., were some of the most affordable rental markets in the U.S., with the median monthly rent making up less than 25% of local households’ typical income in February. Yet even in these areas, rents have been growing faster than incomes—and now take up a larger share of paychecks than they did last year.

How Will Rising Rents Affect Homeownership?

When people have to spend so much of their monthly income on rent, it’s difficult to save up for the down payment needed to purchase a house—often the biggest hurdle for first-time buyers. But for those who have already saved enough, soaring rents could actually push them to make the leap, says Realtor.com’s Hale.

The expectations of potential homebuyers are very important, says Hale: “The majority of homebuyers take out a fixed-rate mortgage, which means the bulk of their monthly housing payment will be fixed—unlike rents that tend to go up every year.” If people expect rents to increase a lot in the future, the buying option would look more appealing even though current prices are high.

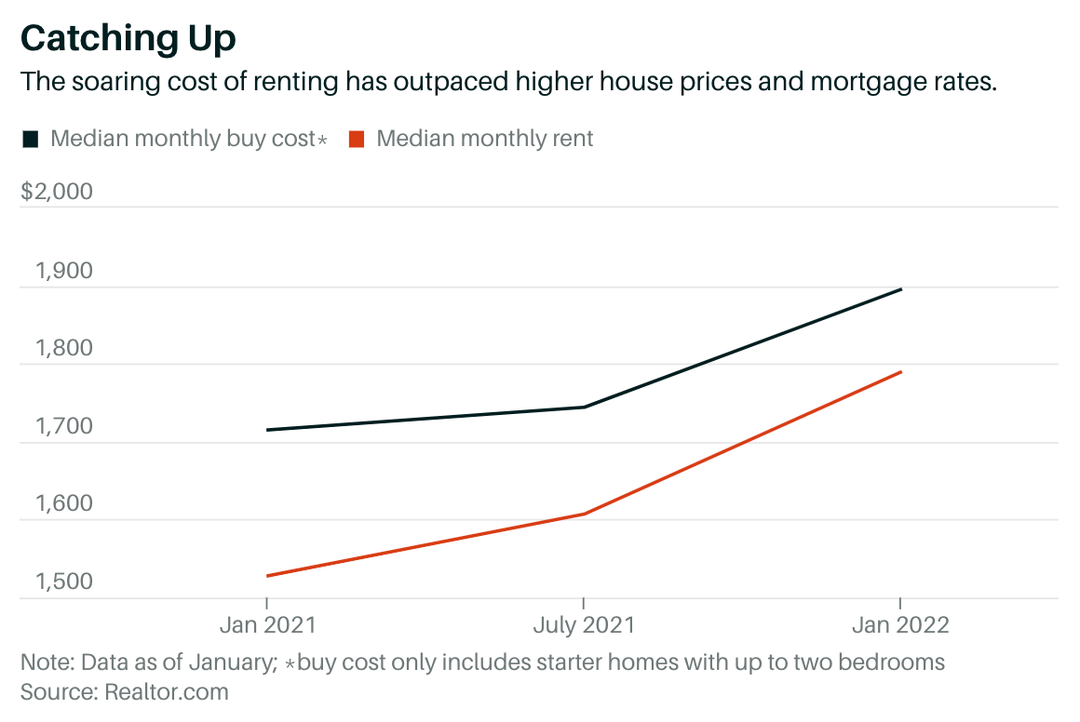

Realtor.com looked at homes for sale and for rent in the same size range—the starter homes with up to two bedrooms—in the 50 largest metro areas across the U.S. In most regions, the cost of renting has grown so fast that it even outpaced the rising house prices and mortgage rates.

Across the 50 metros, the median listing price for a starter home reached nearly $300,000 in January, up by 9.5% from a year ago. The analysts assumed that homebuyers would pay a 5% down payment, something an average renter may be able to reasonably achieve in savings.

Factoring in the higher mortgage rates today, the median monthly buying costs––including mortgage payments, insurance, tax, and homeowner association fees––for a starter home have risen by 11% in 12 months to reach $1,895 in January.

During the same period, the median monthly rent across the 50 metros has soared 17% to reach $1,789. That means the monthly cost of renting is now only slightly lower than owning something of a similar size.

To be sure, even for properties with similar sizes, rental prices aren’t exactly comparable to buying costs, since the mix of homes available to rent and for sale often differ in location and quality. For example, most of the purchased homes may be in the suburbs, while rented apartments may be closer to the city centers. Still, these comparisons can be helpful in painting a larger picture of the real estate market.

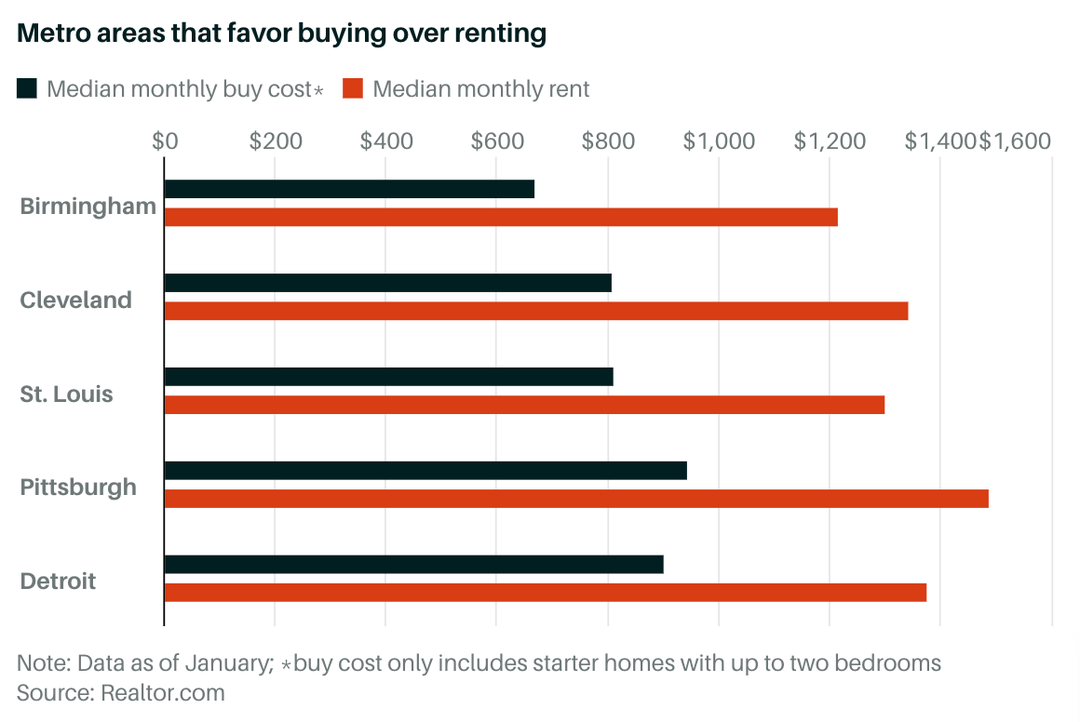

In many metro areas in the Midwest and South, renting is already less affordable than buying. In Birmingham, Ala.; Cleveland; St. Louis; Pittsburgh; and Detroit, for example, the median monthly buying cost for starter homes was over 30% lower than renting something similar in size.

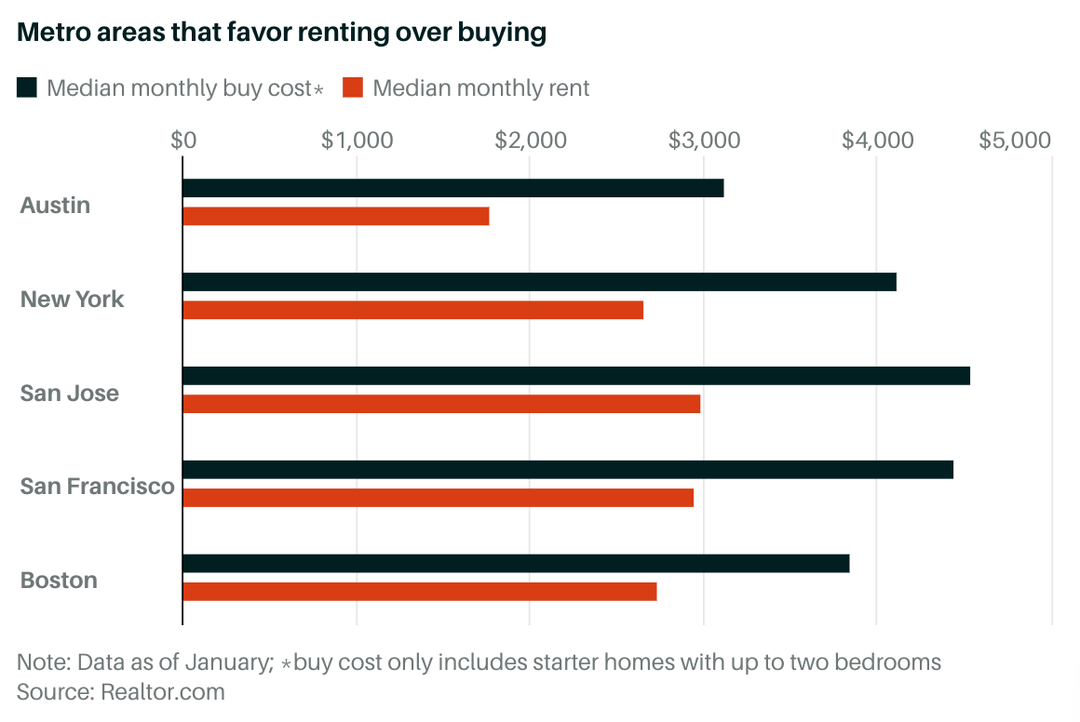

In the coastal tech hubs, meanwhile, buying is still more expensive than renting—partly due to the higher share of condos in those regions and the consequent homeowner association fees. In Austin; New York; San Francisco; San Jose, Calif.; and Boston, the median purchase cost for starter homes was more than 40% higher than rents.

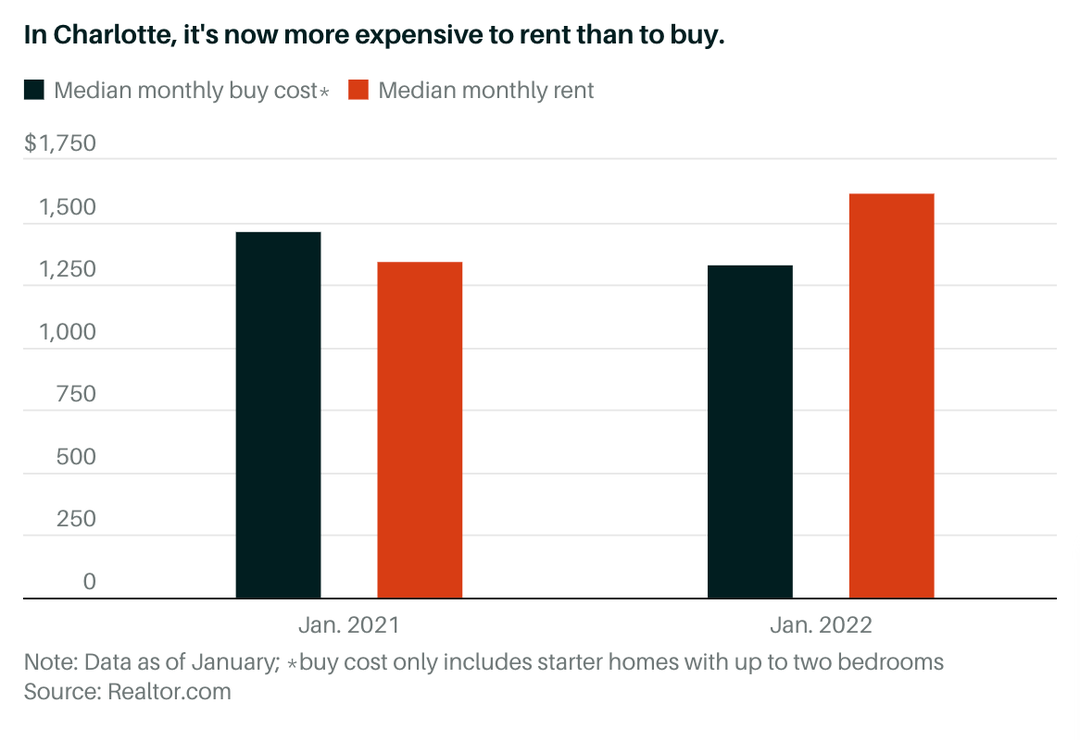

While rent growth has outpaced buying costs in 35 of the 50 largest metro areas, in some markets, those changes have completely tipped over the rent vs. buy equation.

In the Charlotte, N.C., metro area, for example, the monthly cost of buying a starter home has dropped to $1,331 in January from $1,465 a year ago, while the median rent for homes of similar size has increased to $1,620 from $1,344 a month. That means residents in Charlotte, where renting used to be cheaper than buying a house, are now more motivated to buy since renting is now more expensive.

Other areas that have turned from rent-markets to buy-markets include Miami; Minneapolis; Richmond, Va.; and Oklahoma City.

To be sure, falling buying cost for starter homes doesn’t necessarily mean the overall housing market in cooling. In Charlotte, for example, the median listing price for all homes in March is still 8.5% higher than a year ago.

In Charlotte, it’s now more expensive to rent than to buy.Source: Realtor.comNote: Data as of January; *buy cost only includes starter homes with up to two bedrooms

In the short term, it looks like a vicious cycle: Higher house prices forced many potential home buyers to stay renters, which drove up rent prices. When rent becomes too high, though, some people will return to home searching, which will drive up house prices again.

But ultimately, home prices and rents need to be supported by people’s income, says Hale. When income can’t keep up, the housing market can’t sustain double-digit growth for long.

“One reason house prices have outpaced income in the past few years is because mortgage rates have been falling,” she says, “Now that mortgage rates are increasing pretty significantly, it will be a counterbalance to the other factors that are pushing home prices higher.”

Write to Evie Liu at evie.liu@barrons.com

Copyright 2020 Dow Jones & Company, Inc. All Rights Reserved.