US economics, inflation, and geopolitics

April’s pricing data added to inflation concerns. Both the Consumer and Producer Price Indexes came in above expectations, with respective 12-month advances of 8.3% and 11.0%. The metrics showed significant increases in food, energy, and rental apartment prices.

With inflation intensifying and beaming through 8% per annum, the Fed got serious about restraining rising prices and unleashed quantitative tightening. The markets got spooked that the Fed is too aggressive and higher interest rates would stall the economy — the Large Cap Growers went down in flames and classic defensive sectors (Consumer Staples and Utilities) outperformed YTD. Adding to inflationary concerns the war in Ukraine put more pressure on energy prices. Although wages have increased materially across all income groups and savings have not really been tapped into (the US consumers still sit on almost $2.5 trillion of extra savings compared to the pre-covid level), the consumer sentiment index from the University of Michigan has gone down to the lowest reading in a decade (actually a historically bullish signal for the markets going forward).

Macroeconomics and stock market implications

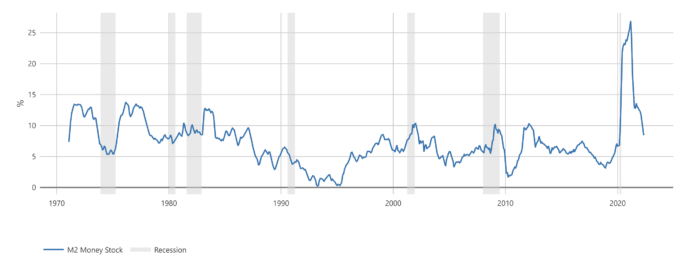

The latest reading from retailers looked discouraging, with Target providing a very conservative outlook for the 2Q 2022 and the whole retail sector going down. The short-term investors’ reaction is usually short-lived, and a company is not valued based on 1 or 2 quarters but as an ongoing concern, the valuation for a company is based on a multi-year outlook. So, this short-term over-reaction is natural, but we should not succumb to this pressure and stay cold-blooded and focused on fundamentals. The input prices are the concern, but secular deflation caused by increased productivity and globalization has not yet gone away. M2 money supply growth (the real major reason behind inflation) has been slowing down, which provides us with the hope that this spike in inflation is not going long-term (see Chart 1).

Chart 1: M2 Money Supply 12 month Growth (as of 04/30/2022)

Source: Signet Financial Management, LLC and The Federal Reserve

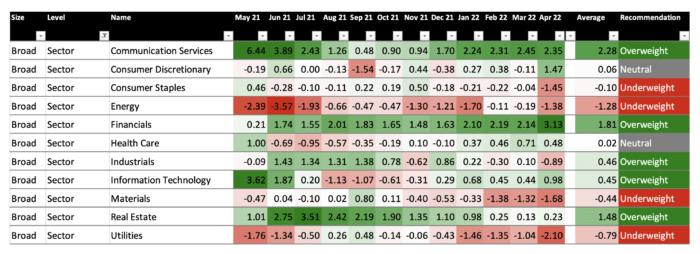

So, we had 1Q economic contraction in the US, the economists predict the second quarter to be positive, but should we get a negative reading and by definition find ourselves in a recession, this recession should be relatively short-lived (remember that powerful consumer). As of now a lot of market participants upped the probability of a recession in the next 2 years to 30%+, but neither our sector forecast (see the heat map below) with mostly cyclical sector forecasted to outperform nor the majority of economists expect the US economy to go into a recession this year, so we believe expansion prevails in 2022.

Sector view and portfolio rebalancing

Recently, we rebalanced our actively managed individual equity portfolios. We kept our barbell approach (although we narrowed it down a bit by over-emphasizing more profitable companies). On one hand, it makes sense to keep exposure to Large Growers of GARP nature (IT, Communications, some Discretionary), the part of Large Growers cohort outperforming their expensive peers in the rising interest rates environment. On the other hand, since we believe that we are still in expansion in the economic business cycle, we find selective cyclicals like Consumer Discretionary, Financials, Industrials, and REITs attractive, especially with a lot of them (Financials and Energy) providing a natural hedge against inflation and a rise in interest rates. Financials have gone down on fears that the Fed would push the economy into recession, but if that proves not to be the case, they can re-rate materially. REITs should benefit from the pent-up demand for housing despite rising mortgage rates, which have gone materially up in the last couple of months. We stay less attracted to Consumer Staples and Utilities.

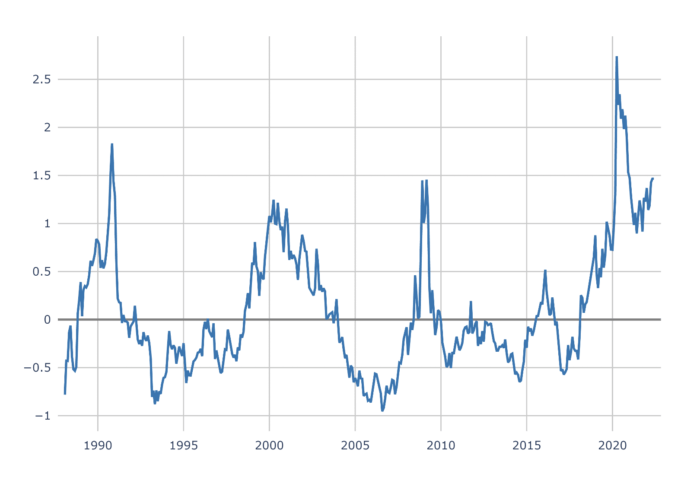

From the Size and Style perspective our Valuation Spreads stay elevated (see the graph below) and hence we tilt a bit towards Value and overweight Mid-Caps giving us a more insulated domestic exposure and attractive fundamentals.

Valuation Spread through April 2022

Source: Signet Financial Management, LLC

The information and opinions included in this document are for background purposes only, are not intended to be full or complete, and should not be viewed as an indication of future results. The information sources used in this letter are: WSJ.com, Jeremy Siegel, Ph.D. (Jeremysiegel.com), Goldman Sachs, JP Morgan, Empirical Research Partners, Value Line, BlackRock, Ned Davis Research, First Trust, Citi research, HSBC, and Nuveen.

IMPORTANT DISCLOSURE

Past performance may not be indicative of future results.

Different types of investments and investment strategies involve varying degrees of risk, and there can be no assurance that their future performance will be profitable, equal to any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful.

The statements made in this newsletter are, to the best of our ability and knowledge, accurate as of the date they were originally made. But due to various factors, including changing market conditions and/or applicable laws, the content may in the future no longer be reflective of current opinions or positions.

Any forward-looking statements, information, and opinions including descriptions of anticipated market changes and expectations of future activity contained in this newsletter are based upon reasonable estimates and assumptions. However, they are inherently uncertain, and actual events or results may differ materially from those reflected in the newsletter.

Nothing in this newsletter serves as the receipt of, or as a substitute for, personalized investment advice. Please remember to contact Signet Financial Management, LLC, if there are any changes in your personal or financial situation or investment objectives for the purpose of reviewing our previous recommendations and/or services. No portion of the newsletter content should be construed as legal, tax, or accounting advice.

A copy of Signet Financial Management, LLC’s current written disclosure statements discussing our advisory services, fees, investment advisory personnel, and operations are available upon request.