The stock market started 2024 strong, hitting record highs in the first quarter. But April brought a pullback, and let’s be honest, that can be stressful. Here’s the thing: downturns are a normal part of the market, even in years that end up positive.

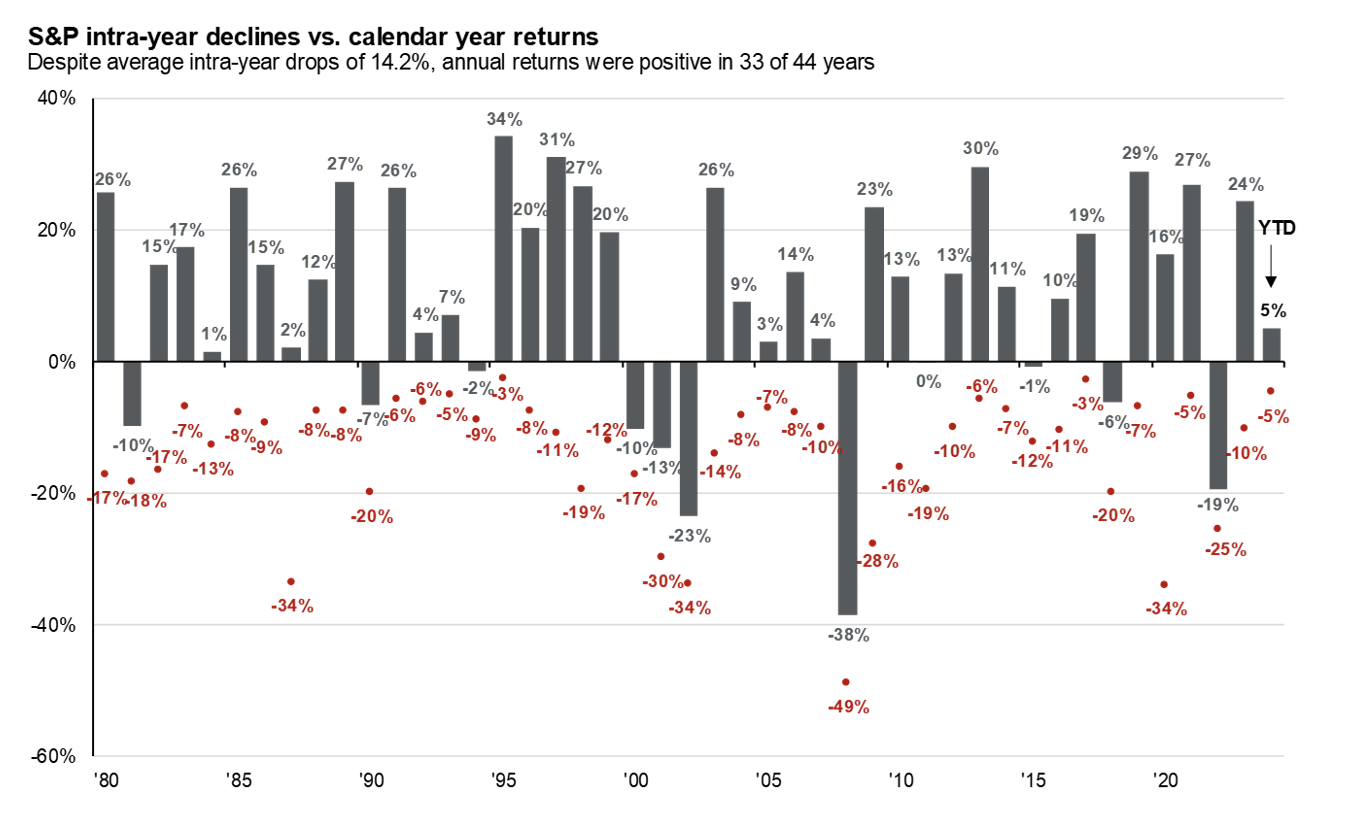

This chart from J.P. Morgan tells the story. It shows the annual return for the S&P 500 (in grey) alongside the biggest sell-off of the year (in red). Remarkably, in the past 44 years, the market experienced an average drawdown of 14% annually, yet still managed to finish positive in 33 of those years! That means in most cases, the market bounced back and surpassed any losses.

So far in 2024, the decline has been around 5% percent, which is less than the historical average. A bigger drop wouldn’t be surprising.

So, what’s causing the jitters? A few things: geopolitical tensions, rising energy prices, and the possibility of higher interest rates.

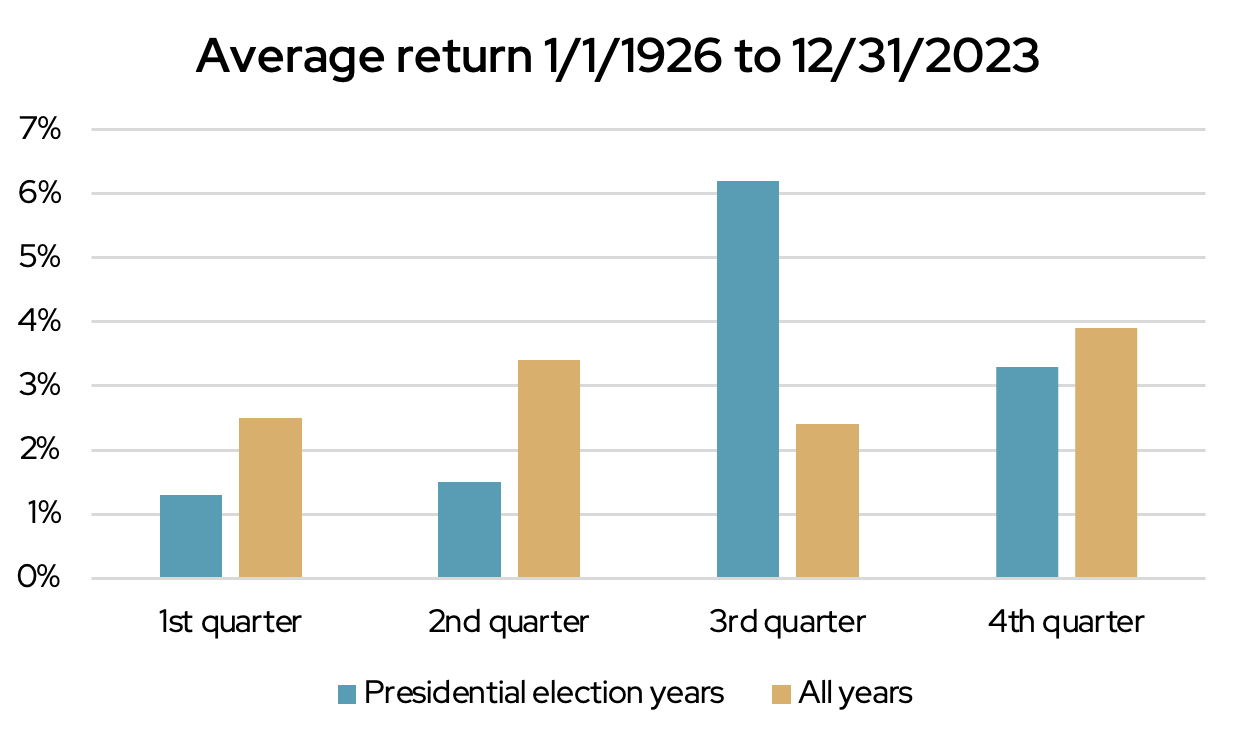

Plus, it’s a presidential election year, which can add volatility. History suggests that presidential election years tend to be pretty good for stocks, especially in the second half of the year.

The key takeaway? Volatility is the price of admission for the potential of higher returns in the stock market.

Don’t let short-term swings throw you off course. Stay focused on your long-term investment goals and remember, this too shall pass.

IMPORTANT DISCLOSURE

This is a publication of Signet Financial Management, LLC.

The information presented is believed to be factual, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Information in this presentation does not involve the rendering of personalized investment advice. It is limited to the dissemination of general information on products and services. A professional adviser should be consulted before implementing any of the options presented.

Information in this presentation is not an offer to buy or sell, or a solicitation of an offer to buy or sell the securities mentioned herein. Information on this presentation is directed toward U.S. residents only. Signet only transacts business in states where it may legally do so.